The impact of covid-19 on business in India

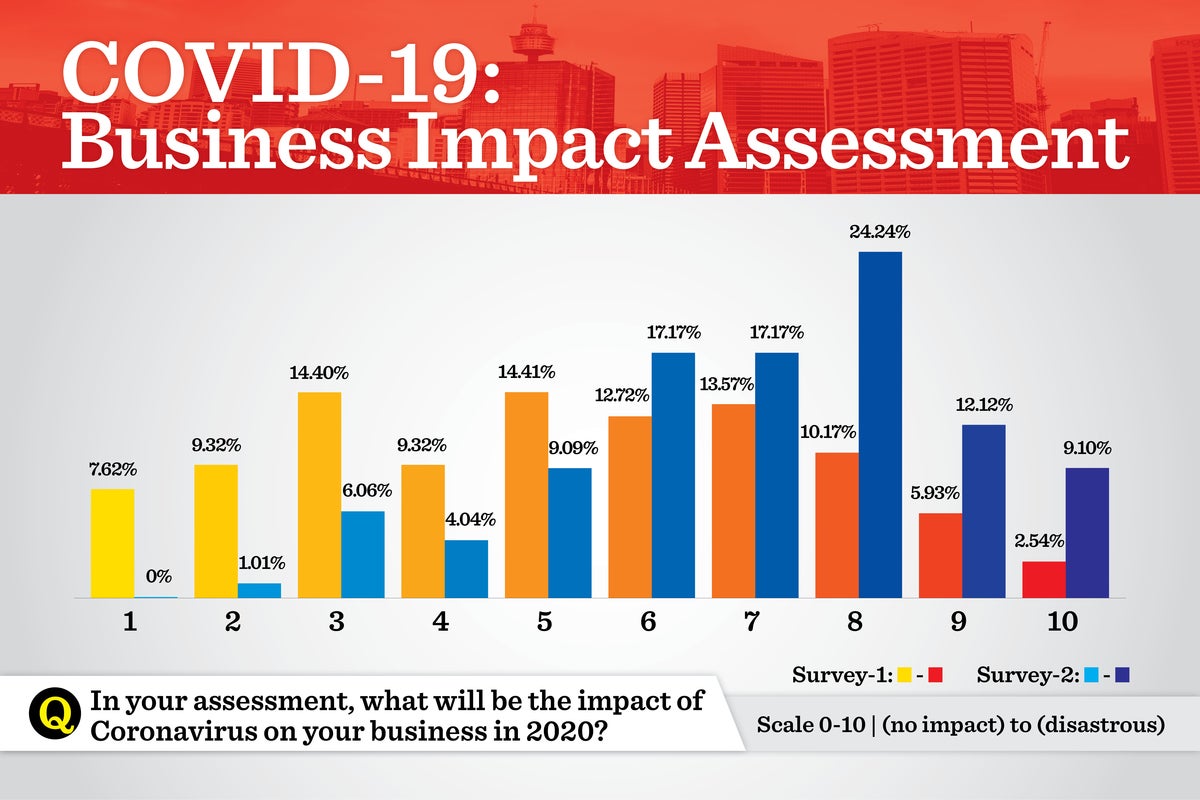

According to a survey conducted to understand the impact of the coronavirus COVID-19 on Indian startups and SMEs, a majority of respondents stated that it would have an impact. About 30 percent of people felt that it would decrease demand for their products or services.

The country went into lockdown on March 25, 2020,the largest of the world, restricting 1.3 billion people. With

COVID-19 spreading rapidly in India, policymakers are worried about how to

fight the virus and minimise its impact on the economy. There are no easy

answers. In addition to containing the spread of the disease and support those

who are affected, policymakers have to be prepared for the long-term challenges

and opportunities that may arise once the crisis is over (and it will

eventually be).

While Covid-19 may not have the scale of pandemics

of the past (as of date), the economic damage has and will continue to affect

more people than the disease itself. Studying past trends of similar

infections can help in drawing inferences as to what might help us going

forward.

It might be a mouthful but here’s a

look at what’s to come in the immediate future. Liquidity is expected to remain

tight as the cost of borrowing in real terms will upwards. This is despite

central banks efforts to reduce interest rates. Banks and financial

institutions will be under immence pressure as the fear of NPAs, insolvency and

bankruptcies increase multifold. The government will focus on meeting hyper

demand for essential goods while non-essential businesses will focus on

recovering their receivables/outstanding money due from debtors.

As an investment professional, I’m

responsible for the management of over $250+ million in client money. My job is

to make bold predictions and then take calculated risks with the objective of

growing my clients’ capital. Like everyone else with an opinion, here are some

of my thoughts on the New Normal for Business.

But before that, a disclaimer. I’m

not a crystal-ball gazer and have no powers beyond my understanding of macro

trends and financial markets. Take this with a pinch of salt. Here goes.

Comments

Post a Comment